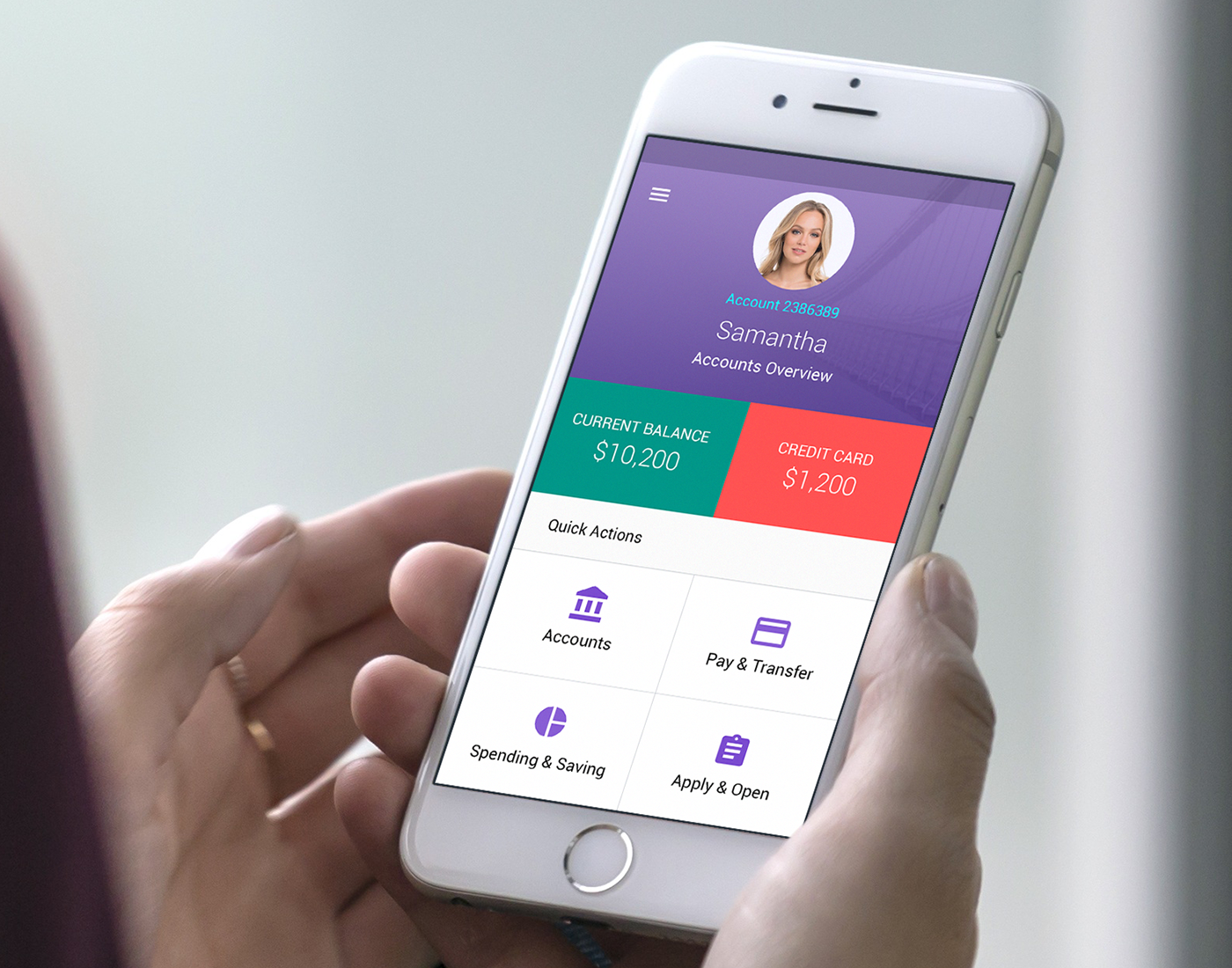

Rilla Delorier, executive vice president, chief strategy officer, Umpqua Bank. We’re already seeing the power and possibilities of technology to create a more meaningful customer experience.” It gives every customer the choice of personal banker devoted to their financial needs regardless of account balance. And this fall we launched the Umpqua Go-To app, our first Human Digital Banking platform. Last year, we unveiled our Human Digital Banking Strategy-a vision for banking in the digital age that keeps people at the center of the customer experience and banking relationship. Umpqua recognized early on that human connection still matters, even as DIY digital banking tools continue to proliferate. They need help navigating those moments when life and money meet. “Consumers want and need more than a digital-only experience from their banks. Ed Price, director of compliance at Devbridge Group. So the true challenge for the C-suite lies in finding where it makes the most sense for their business.” Voice user interface improves customer engagement, conversions and insights. They also need to do more than just optimize for sound-driven search. Companies must begin to support a voice-first approach or get left behind. By 2020, 50 percent of all web searches will be voice generated. “Many experts are convinced voice will be the dominant user experience in the next year or two. Prominence and dominance in voice banking Chase Bank, for example, is offering cardless, app-based ATM transactions at specific locations, working with Apple Pay, Google Pay and Samsung Pay.”

Ntouch mobile banking code#

Others could use a QR code or give you codes to punch in.

Some ATMs are using near-field communications technology and/or Apple Pay. That means no more getting stuck without cash if you don’t have your card on you or if it’s stolen. “The thing I’m most excited about is the ability to withdraw money at ATMs using only an app. We asked some smart people in financial services to tell us what they see coming and growing in the mobile realm in 2019. There’s even a growing trend for ATM withdrawals without your chip card-which would’ve sounded like a magician’s card trick just a generation ago. Mobile banking is exploding with new ideas from voice-first development, to putting humans back into the digital experience to artificial intelligence and advanced biometrics.

The top 10 mobile banking trends for 2019

Ntouch mobile banking verification#

0 kommentar(er)

0 kommentar(er)